If your cars and truck is amounted to, gap insurance coverage will assist pay off the balance of your loan. No-fault pays medical expenditures, and sometimes, loss of earnings, important services, accidental death, funeral costs, and survivor benefits. If you have actually had tickets, accidents, a DUI, or need an SR-22, Highway Insurance coverage can help. what is the difference between whole life and term life insurance.

The suggestions of our insurance specialists will assist you discover the best rates based on your specific scenario. In addition to, there are other benefits to insuring your vehicle through Highway: Highway is recognized as a brand name you can trust and has been helping motorists save money on automobile insurance for over 30 years We use a broad range of auto insurance alternatives from the most fundamental to premium Economical car insurance policies for high-risk motorists who have been denied in other places due to tickets, accidents, DUI, or SR-22 requirements Over 500 convenient office places where you can pay your expense or discuss your policy English and Spanish-speaking representatives offered to address your concerns personally or by phone Freeway Insurance coverage makes it easy to get.

You can likewise stop by among our conveniently-located workplaces where an insurance coverage expert will help you discover the best policy. Have concerns? Visit our automobile insurance coverage Frequently asked questions.

So why is it some vehicles seem more "insurable" than others? Is it a bias towards make or design? What about price range or trim level? While a few of that matters, it is a much larger photo answer than that. Among many elements, insurance provider consider what it costs to fix or change your vehicle when determining rate.

Things about How Much Is Urgent Care Without Insurance

In reality, some vehicles, just http://brookswlsn220.jigsy.com/entries/general/the-basic-principles-of-how-do-i-know-if-i-have-gap-insurance by virtue of their design and manufacture, will save vehicle consumers cash on their car insurance coverage. We took a look at the top 100 make and model mixes for 2018 cars to compile a list of the most inexpensive vehicles to guarantee. 4 of the leading six spots are held by crossovers and SUVs.

Rank Green Cars 1 Honda Fit 2 Ford Carnival SFE 3 Honda CR-V 4 MINI Cooper Countryman 5 Ford Edge 6 Mazda3 (5-door) 7 Toyota Highlander Hybrid LE Plus 8 Hyundai Elantra 9 Ford Focus Electric FWD 10 Toyota RAV4 LE/XLE Electric lorries have come a long way, as the marketplace has actually seen a consistent stream of new models that you can buy.

Rank Electric Cars 1 Fiat 500e 2 Kia Soul EV 3 Nissan Leaf 4 Volkswagen e-Golf 5 Smart ForTwo Electric Drive 6 Mitsubishi i-MiEV 7 Ford Focus Electric 8 Hyundai IONIQ Electric 9 BMW i3 10 Tesla Model 3 The National Highway Traffic Security Administration's (NHTSA) 5-Star Safety Scores Program offers customers with information about the crash security and rollover security of new vehicles, with more stars equaling much safer cars and trucks.

Rank Cars for Teenager Drivers 1 Kia Sportage 2 Kia Soul 3 Hyundai Tucson 4 Honda CR-V LX 5 Honda Fit 6 Hyundai Elantra GT 7 VW Golf Sportwagen SW 8 Subaru Wilderness 9 Dodge Dart 10 Honda HR-V EX.

The Buzz on How To File An Insurance Claim

Discovering the most inexpensive car insurance coverage takes some knowledge and research. Let's face it: it's a tedious job. You may be tempted to avoid the legwork and simply renew your policy without any cost savings. But don't stress. By making a couple of, smart choices, you can find the cheapest automobile insurance coverage for your situation, and not jeopardize the coverage you require to secure yourself economically.

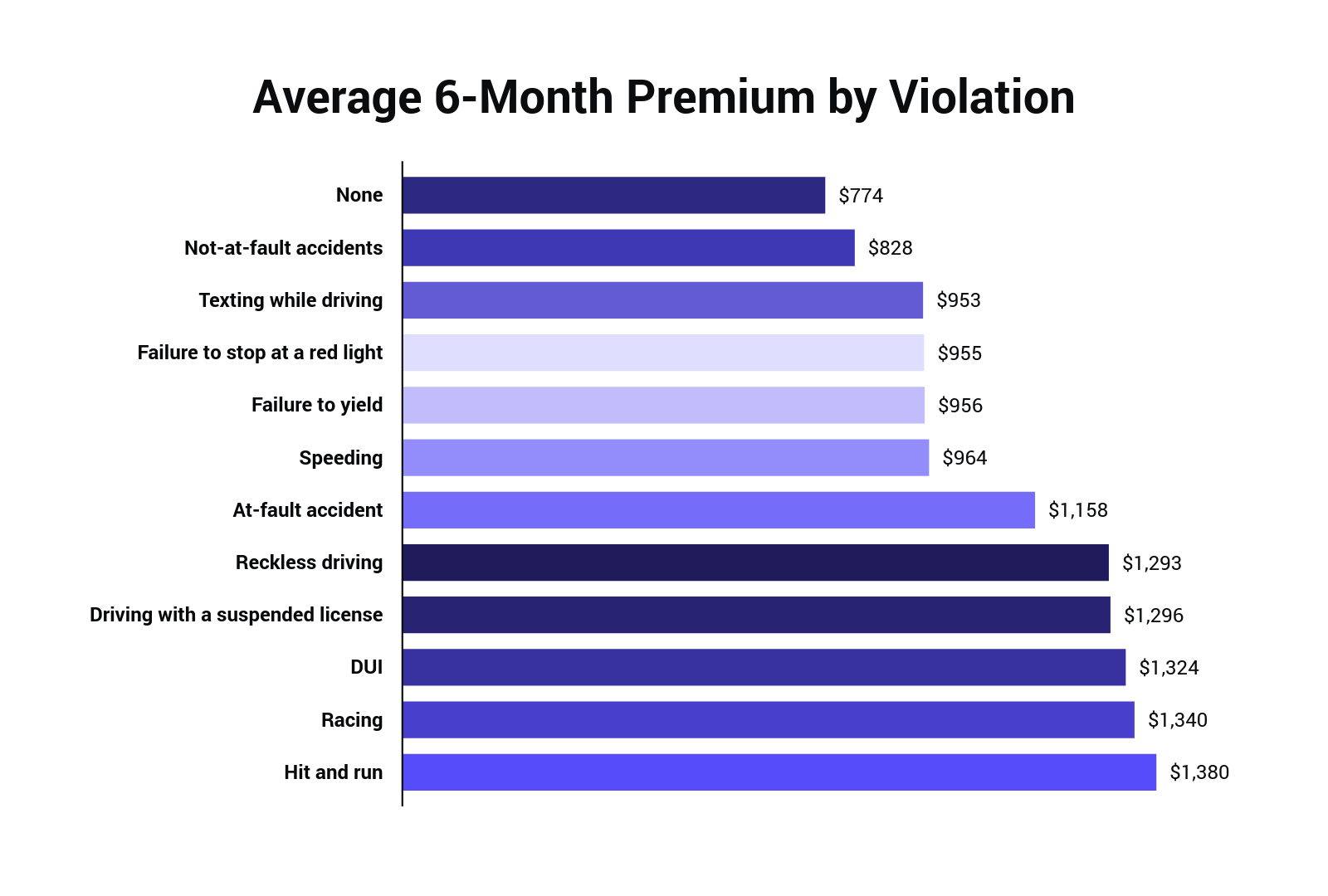

Comparing vehicle insurance coverage prices estimate from several insurer is the most effective way to get cheap vehicle insurance coverage. Our team of insurance specialists looked into cars and truck insurance coverage estimates fielded from major business for various motorist profiles and protection levels to discover the most cost effective automobile insurance rates. The data listed below program typical costs broken down by different variables to highlight factors that might increase or decrease your rates, and to offer you an idea of what you can expect to pay.

Below, you'll see the leading five most inexpensive car insurance provider noted with their typical rates for coverage. Geico was the most budget-friendly amongst the insurance companies researched, and the rest of the business are all within a $100 of each other. how much does insurance go up after an accident. The same holds real when looking at how vehicle insurance provider rank on rate for simply state needed minimum coverage.

And yet, you do not want to purchase cheap cars and truck insurance and then be stressed that you aren't adequately covered. Cheap automobile insurance need to never ever be simply about price it indicates finding the coverage you need at a cost that fits your spending plan. Our editors and customer analyst will show you how to discover cars and truck insurance coverage that has the very best value for you at a cost that will still net you cost savings.

An Unbiased View of How Do I Get Health Insurance

Rates vary by hundreds of dollars among business, which is why it actually pays to look around. For circumstances, our specialists performed a rate analysis and discovered the following prospective savings, or the distinction in between the greatest and lowest price, for the very same policy: Complete coverage average savings of up to 178% or $1,1647 When broken down by state, cost savings are a lot more significant in some cases.

But even in states where the savings are much lower, you can still avoid overpaying by hundreds of dollars. Learn more about typical automobile insurance coverage savings by stateIf you're wondering who has the cheapest automobile insurance coverage near you, our rate data can help. Here we reveal average cars and truck insurance coverage rates from major insurance companies, ranked from least to most pricey, for each state, for a complete protection policy.